What Is Economic Obsolescence?

Posted by Valentiam Group on April 20, 2020

Functional, physical, and economic obsolescence each have a detrimental impact on the value of the real property; these types of obsolescence can also reduce the value of business assets.

Physical obsolescence is fairly straightforward; it occurs when a physical asset such as a piece of machinery is so worn from use that replacement is the most practical or financially feasible option. We examined functional obsolescence in a previous article; it occurs when an asset becomes less useful due to a design which can’t be easily updated. In this article, we’ll define economic obsolescence and look at how its impact on assets can be calculated.

Economic Obsolescence: A Definition

In the simplest terms, economic obsolescence represents a loss of value due to factors external to the asset or business. For this reason, the term external obsolescence is used interchangeably with economic obsolescence.

A wide range of external factors can significantly affect the value of a business or its individual or collective assets:

- Industry economics

- Regulatory/legislative changes

- Loss or scarcity of resources

- Increased costs of production inputs, or inability to pass on increased costs

- Reduced demand

- Increased competition

- Reduced earnings or profit margins

In short, any external factor that impacts the profitability of the business or the value of its assets can be attributed to economic obsolescence, in the absence of functional or physical obsolescence.

If, for example, you owned a company in the early 1980s that produced Betamax videotapes, your company would have been subject to external obsolescence due to increased competition, reduced demand, and reduced earnings/profit margins—the result of the VHS videotape format achieving market dominance. Specialized machinery needed to produce your Betamax tapes would have lost value due to functional obsolescence resulting from the external factor of competition. Although the machinery’s loss of value flowed from economic obsolescence affecting the entire company, the loss would have been attributed to functional obsolescence for that particular asset, since the machinery was specifically designed to produce a product that no longer had a market.

Tariffs are another example of economic or external obsolescence—they impose additional costs on certain goods and materials, some or all of which are not easy to pass on to customers, and are the result of a change in government policy. Examples include imported steel and exported beef.

External obsolescence is typically beyond the scope of the business owner’s control, and can occur at any time during an asset’s life. It is manifested in the business’ profit margin. When the operating margin of an asset or assets is lower than what provides sufficient financial return to the supporting assets, and there is a difference between the existing operating capacity and sufficient operating capacity, economic obsolescence may be the cause.

Need help calculating the depreciation of assets due to functional, physical, or economic obsolescence? Schedule a free discovery call with our valuation experts.

Calculating The Level Of Economic Obsolescence

Identifying and measuring economic obsolescence relies on input from valuation experts skilled in business and fixed asset valuation, and several iterations of value calculations to identify which assets are subject to external obsolescence, and to what degree.

Considerations For Fixed Asset Valuations

Fixed assets are initially valued assuming an in-use premise. All other forms of depreciation—such as physical and functional obsolescence—are calculated, and the utility of the asset is then compared to its rated capacity—the full productive capacity of the asset under conditions of full operation at that point in time. Full operation is typically assumed to be in the range of 85%–95%, since most operations have downtime for maintenance. An asset found to be less than fully utilized will have an economic obsolescence adjustment applied to establish fair value.

If economic obsolescence is initially suspected due to industry, business, or economic factors, or the purchase price (if the business has recently been acquired by another company), the floor value of the fixed assets subject to external obsolescence should also be estimated. Typically this floor value will be based on salvage value of the assets or the net orderly liquidation value. Establishing a floor value helps to ensure that economic obsolescence is not overestimated; post-economic obsolescence fair values will generally fall in between the in-use value and the net orderly liquidation value—though in cases where economic obsolescence is likely to be substantial, the floor value may be supported by the forced liquidation value.

If the assets being valued include real property, the property must be assessed to determine if economic obsolescence is applicable. The determination of economic obsolescence in real estate differs because land and structure values are based on comparable sales; external obsolescence in real estate refers most often to the desirability of the location. (Tweet this!) If a business owns property in an area that was a thriving hub of activity 15 years ago but has since been abandoned by most other businesses, or in an area surrounded by abandoned buildings and empty lots, it is likely to be subject to economic obsolescence.

Other Valuation Considerations

After the fixed assets are assigned a value based on the in-use premise, the collective value of all identified assets is compared to the overall, enterprise value of the business. Economic obsolescence may be indicated if the purchase price of the business or its enterprise value does not align with the collective value of all tangible and intangible assets. If the value of all assets (except goodwill) and working capital is less than or equal to enterprise value or purchase price, it is an indication that a reasonable valuation for the fixed assets has been calculated. But if the sum of asset values exceeds the purchase price or enterprise value (negative goodwill value), further review of the fixed assets is necessary to determine the level of economic obsolescence.

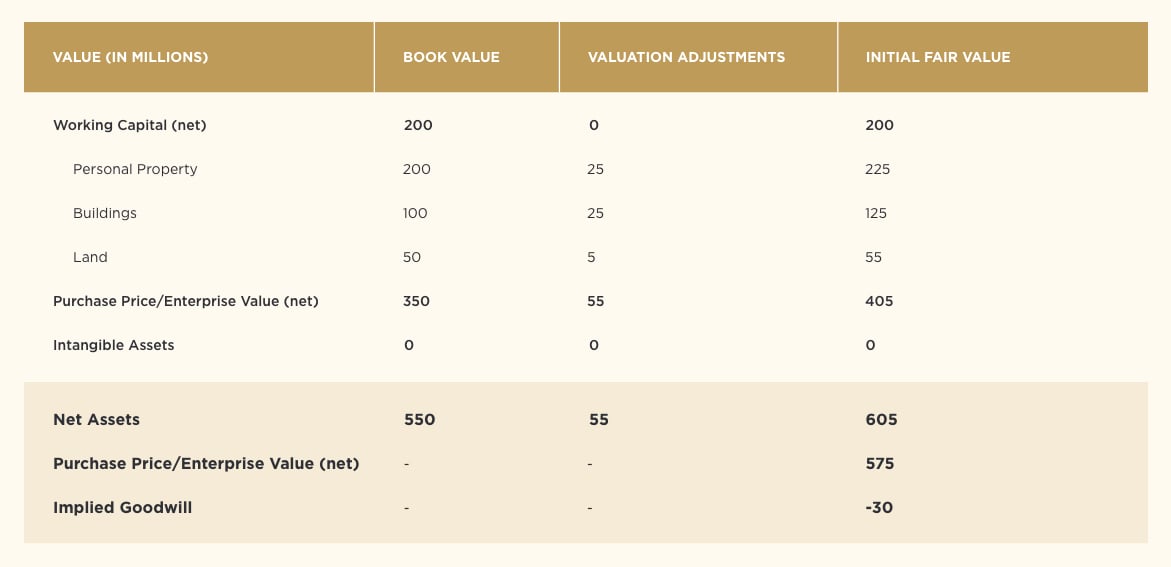

The enterprise value or purchase price of a company will determine economic obsolescence. In the following example of a single reporting unit company, the initial valuation indicates that the purchase price is lower than the collective fair value of acquired assets. For the purposes of simplification in this illustration, assume that there are no intangible assets.

Negative goodwill is indicated in the example. But if instead the fixed assets have lost value due to external factors, additional calculations are necessary to account for the economic obsolescence of specific assets.

After estimating the total economic obsolescence, it is assigned to the appropriate fixed assets, taking into consideration the floor values of the individual assets. The assignment of economic obsolescence may not be evenly allocated across all assets; as previously noted, it may not be applicable to the value of land, where comparables are used to determine value.

More complex cases may require disaggregation of enterprise or reporting unit value among groups of assets, to determine if the economic obsolescence applies to the company as a whole or is applicable only to certain assets—or whether some assets have a higher degree of economic obsolescence than others. Discounted cash flow models can be used to allocate enterprise value to various components of the business; these are reconciled back to the aggregate value, taking into consideration specific characteristics of the assets and their floor value estimates. This allows determination of the level of economic obsolescence operable in each business unit. Some units may have none, while others may have substantial economic obsolescence resulting in lower profitability.

Consideration Of Intangible Assets

When economic obsolescence is present in the fixed assets, valuation of intangible assets should be considered. Intangibles are often assigned minimal or no value when there is significant economic obsolescence in the fixed assets. Intangibles such as customer relationships and intellectual property-related assets that may have value in the market may be assigned a positive value, but the assessment is subjective and will affect the magnitude of the economic obsolescence adjustment. Therefore, in valuing intangible assets, it is critical to make the assessment from the perspective of a market participant to determine the fair value of the assets.

It is often clear from the beginning that some level of economic obsolescence is present in a business or business unit. Expertise in the valuation of multiple types of assets— personal property, businesses, intangible assets, and real estate—is critical to identifying and determining the level of economic obsolescence in fixed assets and arriving at reasonable and defensible values.

Need to gain a clearer understanding of the value of all your business assets?

Valentiam can help. Our valuation experts have decades of combined experience in providing accurate and defensible valuations and transfer pricing services. We have worked with some of the largest companies in the world, including several Fortune 100 organizations. Give us a call to explore how we can assist you with your valuation and transfer pricing needs.

Topics: Property valuation, Business valuation

Related Posts

Valuation Allowance For Deferred Tax Assets: A Quick Guide

ASC 820 compliance sometimes requires a valuation allowance for deferred tax assets. Here’s why—and how valuation allowances are applied.

How To Value A Commercial Property

Valuing your business's property has a direct impact on your bottom line. In this article, learn how to utilize the two primary valuation methods.