What Is Functional Obsolescence?

Posted by Valentiam Group on April 1, 2020

Functional, physical, and economic obsolescence in real estate are all commonly understood to have negative impact on value—but these types of obsolescence can also have a detrimental impact on the value of business assets.

Economic obsolescence, alternatively called external obsolescence, is perhaps the most easily understood. This type of obsolescence can occur when factors external to the business change: There is a reduction in demand due to recession; there are increases in material, labor, or utility costs; passage of new regulations increases costs; there is increased competition; or other factors. Physical obsolescence is also fairly straightforward: It occurs when a physical asset such as a building or a piece of machinery is worn from any type of use.

The definition of functional obsolescence is a little more nuanced; it can impose costs to the business external to the value of the asset itself. In this article, we’ll examine what constitutes functional obsolescence, and its potential costs.

What is functional obsolescence?

Functional obsolescence occurs when an asset becomes less useful or desirable due to an outdated design that can’t easily be updated or changed. (Tweet this!) In recent decades, functional obsolescence is most often the result of new technology; a good example is VHS videotape. After DVD distribution surpassed VHS in 2003, consumers discarded millions of still-operational VHS players over the next decade, as the VHS format was phased out.

Business assets are also subject to functional obsolescence. For example, companies are constantly updating their computer and software systems, as computing power advances and software becomes outdated. Software manufacturers may stop providing updates or patches after several years, requiring the purchase of new software. Alternatively, new technology for mobile telecommunications may render a prior network functionally obsolete. In either case, functional obsolescence imposes a cost.

Need help calculating the depreciation of assets due to functional, economic, or physical obsolescence? Schedule a free discovery call with our valuation experts.

Causes Of Functional Obsolescence

To understand the various costs associated with functional obsolescence in a business context, consider this example—extreme for the purposes of illustration:

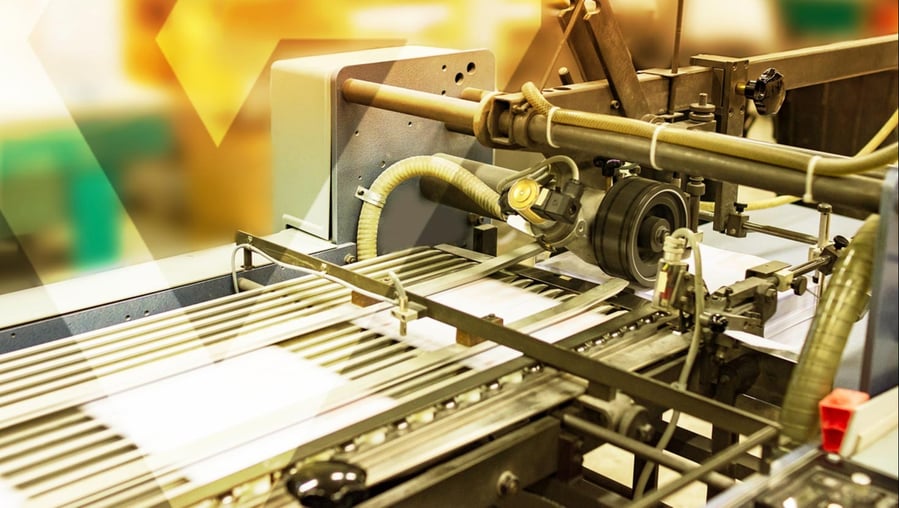

Suppose you are a publisher still operating an old (pre-digital) printing press, where all the type must be handset, while all other publishers have upgraded to digital presses. There are three cost issues associated with doing the work the old-fashioned way:

- Increased operating costs: Old equipment is less energy-efficient and results in increased utility costs, and hand-setting type is time-consuming, increasing labor costs.

- Increased maintenance costs: Old equipment is less durable and requires more maintenance, increasing maintenance costs.

- Lost profits: Old equipment results in lost opportunity for additional profits. In our example, due to the labor and time involved in typesetting, your old printing press can produce 100,000 books per year, while a new digital press can produce a million books per year. Even if you have demand for printing more than 100,000 books, with the old equipment, you can’t take advantage of the opportunity. Moreover, with the old press, you might not be able to print certain designs nor charge the same fees as compared to the owner of a more functional and higher resolution digital printing press.

A plant using old-fashioned printing presses is much less productive due to functional obsolescence of the machinery, which results in additional costs and foregone profits.

Companies must consider functional obsolescence in long-term business planning, with the goal of measuring and tracking assets’ declining value over time. This allows budgeting for purchase of new equipment and planning for the sale of assets due for an upgrade as well as prudent tax planning for property tax purposes. Various accounting methods can be used to calculate the depreciation of assets. However, such methods provide only a partial and incomplete assessment of the current value of an asset. The real goal is to track the assets’ declining value due to various obsolescence factors to establish a reasonable fair value of an asset for valuation and property tax purposes.

Want to gain a clearer understanding of the value of all your business assets?

Valentiam has helped companies in a variety of industries attain much more accurate valuation and property tax assessment of assets. Our valuation and transfer pricing specialists have worked with some of the largest companies in the world. Contact us to see how we can help your company with your valuation and transfer pricing needs.

Topics: Business valuation

Related Posts

EBITDA Multiples By Industry: An Analysis

EBITDA multiples by industry indicate growth, profitability, and stability of profits in various sectors—and are a quick and easy way to estimate value.

Valuation Methods: A Guide

Different types of business valuation methods are suited to specific needs. Here are the three primary types of valuation techniques and when they should be used.