Valuation Methods: A Guide

Posted by Valentiam Group on September 8, 2021

Just as there are a variety of reasons for seeking a business valuation, there are several different types of valuation methods which can be used to calculate a fair and defensible value for the business or its assets. Selecting the best valuation method is the first step in establishing the value of the business or business assets.

There are several considerations to take into account when determining which type or types of valuation to use for a specific case, including the reason for the valuation, the industry, and characteristics of the specific business. Many cases call for a combination of valuation analysis methods to reach a defensible value. In this article, we’ll look at the different valuation techniques most commonly used and accepted in accounting practice, and which are best suited for each purpose.

Purpose Of The Valuation

A number of situations require determination of a company’s current economic value:

- Desire to sell the business due to retirement, divorce, or health or family reasons

- Need for debt or equity financing to underwrite expansion or address cash flow issues

- Addition of new partners or LLC members

- Sale of a share of the business by a partner or member

- Calculation of value for tax purposes

The reason for performing the valuation will establish the scope of the valuation analysis—is it for establishing real property value for real estate tax purposes, or is it for determining the value of the business for sale purposes? The reason for the valuation will provide a necessary data point for the best valuation analysis methods to use. (Tweet this!)

Need an experienced analyst to help determine the most appropriate valuation method—and provide an expert value opinion? Schedule a free discovery call with Valentiam.

Types Of Valuation Methods

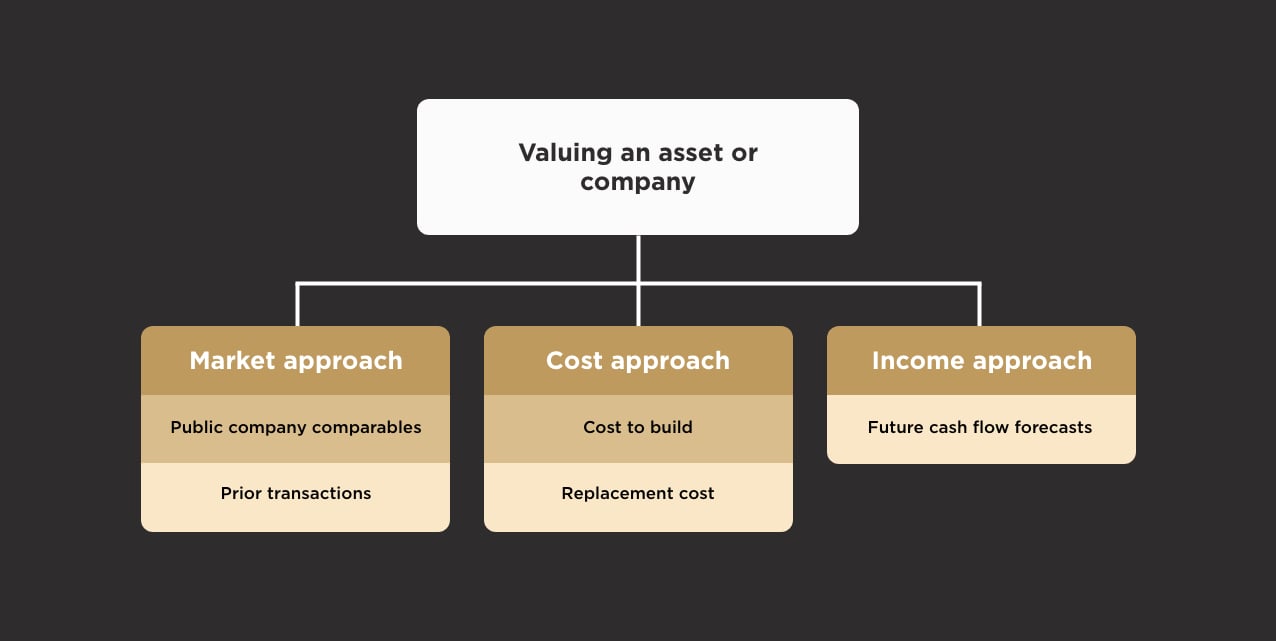

Three main types of valuation methods are commonly used for establishing the economic value of businesses: market, cost, and income; each method has advantages and drawbacks. In the following sections, we’ll explain each of these valuation methods and the situations to which each is suited. We will also look at examples in the power industry to demonstrate how each method could be used in valuing a specific type of business asset.

Market Valuation Methods

There are essentially two market approaches to valuing a business.

The first relies on finding comparable companies, analyzing price/earnings ratios and other value indicators, establishing an average, and applying it to the subject company. This is obviously a very imprecise way to assess value, due in part to the fact that markets can under- or over-value companies. Also, it is hard to estimate how much the difference in multiples among similar companies is due to individual company specific factors.

The second market valuation approach is similar to the use of real estate comparables. This approach relies on a sales analysis of similar properties, and indicates full cash value by analyzing recent sales or offering prices of similar companies. If similar transactions are not identical to the subject business, the selling price of the comparable property is adjusted to reflect differences from the subject business.

In our example case, a power generation plant may be valued using the market valuation method. Using the market approach might entail looking at a recently constructed plant in the same market, instead of looking for transactions, which are likely to be few and far between. If there are no comparable assets in the market, a plant that is currently under construction or has been approved for construction could be used for comparison.

Just as in real estate valuations, the comparable plants have to be adjusted to reflect the differences from the plant you are trying to value. For example, in a real estate valuation, if you are using a comparable house that has 3 bedrooms and the property being valued has 2, then the comparable house's sales price is adjusted for the extra bedroom. The same principle applies to power plants. The asset can have a different life span; evolving environmental and public policy regulations have a big impact on value. For example, if the plant being valued is coal-fired, there can be environmental or regulatory concerns that are likely to make coal-fueled power generation unfeasible economically.

There are several drawbacks to the market approach. In many situations, the market may not be active enough to provide sales data on comparable properties, and there may not be credible sources to provide independent verification of value. For valuation of large, complex, income-producing properties, a thorough analysis of similar transactions is complicated; not only are there fewer of these transactions, but information related to the economic factors which influenced the decisions of buyers in those transactions is not available through public records. These types of transactions often include purchase of intangible assets such as trademarks, patents, favorable contracts, trade secrets, and customer relationships. The actual fair value of these assets is opaque to an outsider who was not involved in the sale.

To be useful for comparison purposes, the sale price of a comparable company should identify its value components—tangible versus intangible assets, real versus personal property, and taxable versus non-taxable assets. Even if the appraiser can allocate the different elements of value, the complexity of factors may make the sale a less reliable indicator of enterprise value. And even if all the necessary information is available, the process of making value adjustments to the comparables and the subject company is subjective, and thus, produces a valuation that is not as solidly defensible as one calculated via a different valuation technique.

For these reasons, the market valuation method may provide some useful data points regarding the “going rate” for a similar business at a given point in time—but in many cases, it will not adequately assess the company’s actual fair value. However, the market approach is sometimes used as a merger and acquisition (M&A) valuation technique. In an M&A transaction, the acquiring company often anticipates achieving some type of business synergy through the acquisition of the subject business, and as a result, is not as concerned with establishing the exact value of the subject company when negotiating the purchase. The market valuation approach is also one of the most commonly used valuation techniques in finance.

The Cost Valuation Method

The cost approach is based on the logic of the principle of substitution. The concept is that prudent investors will not pay more for a property than they would for a substitute property of equivalent utility. As with the market approach, there are two potential starting points for a cost approach to valuation: reproduction cost and replacement cost.

- Reproduction cost is the estimated cost, at current prices, to create an exact replica of the subject asset, using the same materials, construction techniques and standards, design, and quality of workmanship, and incorporating all the property’s deficiencies, over-adequacies, and obsolescences into this exact duplicate.

- Replacement cost is the cost to replace an existing property with a new one of equivalent utility, as of a specified date.

For obvious reasons, the replacement cost is more meaningful in terms of the principle of substitution; a prudent investor would not choose to replicate an existing property and incorporate obsolete, redundant, or unused features.

Using our example case of power plants, if a company is considering purchasing a plant that serves 100,000 people, it will not pay more for an existing plant than it would spend to build a new plant to serve the same 100,000 people. The cost of a new plant can be determined by figuring the cost of materials and the cost to build. The cost to build a new modern and functionally equivalent plant will typically be lower than recreating the existing plant. The new plant can be built in a less expensive, more efficient way, using the latest construction materials and techniques and the newest technology. The new plant will exclude obsolete equipment that is less efficient. Additionally, the new plant avoids the cumulative capital maintenance cost that creates “ghost assets”—assets that exist but are not used to functional capacity—on the books. The cost is then adjusted by depreciation to arrive at the current replacement value less depreciation of the subject power plant.

One advantage of the cost approach is that it is a very solid capital valuation method supported by current market costs and operating environment. It provides a clear value for the tangible property, because that value has been clearly separated from all other assets. Used in conjunction with the income approach, the cost approach allows intangible assets to be valued indirectly. Tangible values established through the cost approach are subtracted from the enterprise value established by the income approach; the remainder is the value of the intangible assets.

In terms of limitations, the cost approach requires a lot of reliable data. It requires calculating the costs of materials, equipment, and labor, and, for our example, developing information regarding the most efficient way to service those 100,000 customers. Finding and developing this information is very data- and time-intensive.

The Income Valuation Method

The income approach is based on the premise that a property’s current full cash value is equal to the current value of future cash flows it will provide over its remaining economic life. It is a classic approach to valuation but requires an extensive amount of detail and analysis. The income valuation method has the highest model risk—the risk that your model turns out to be inappropriate—as it relies on many assumptions. The effort required for using the income method will also, however, often result in a more accurate appraisal, especially when combined with other valuation methods. This approach allows value to be forecasted based on different scenarios and can be used to perform a sensitivity analysis.

There are several steps to applying this approach:

- Estimation of annual cash flows a prudent investor would expect to receive from the subject property over a defined period of time.

- Conversion of estimated cash flows to their current value equivalent using a rate of return that accounts for relative risk of the projected cash flow and the time value of money.

- Estimate of residual value, if any, at the end of the defined projection period.

- Conversion of residual value, if any, to its present value equivalent.

- Addition of the current value of estimated cash flows from the defined projection period to the residual value, if any, to arrive at the company’s enterprise value.

- Deductions for working capital, intangible property, and other excluded assets of the enterprise value to arrive at an indication of value for the subject company’s tangible assets.

The income approach is relevant if the goal is to arrive at a fair and defensible enterprise value. For situations such as establishing value for property taxes, however, tangible property needs to be specifically valued separately; the income approach does not allow separation by type of asset. The other limitation is that the calculated value is very sensitive to assumptions about the forecast period, the cost of capital, and the terminal growth rate derived; any small changes in these key assumptions can materially impact the assigned value. The COVID-19 pandemic provides a reminder that projections made years into the future may or may not hold true. Cost of capital projections should reflect the risk in achieving the forecast returns; clearly a new restaurant or hotel that opened its doors in March 2020 would not have performed as forecast in a business plan developed a year previously. Therefore, income-based valuations are most reliable for businesses with stable, predictable cash flows.

As previously noted, the income approach can be combined with the cost approach, which will allow the direct valuation of tangible assets and indirect valuation of intangible assets. Intangible assets can also be modeled separately and that value can then be checked from the resulting residual intangible value from the business enterprise income approach. This combined approach will provide a defensible fair value for most purposes where a business valuation is needed, in addition to providing values for different types of assets.

Regardless of the purpose for seeking a valuation, arriving at accurate, defensible values for businesses and/or business assets is an arduous and complicated process requiring the skills of experienced valuation professionals. A business valuation expert has the knowledge and experience needed to choose the best valuation method for your specific needs and calculate a fair and accurate value.

Need help determining the fair value of your business?

At Valentiam, our valuation specialists are experienced in all valuation methods acceptable in accounting practice. We bring collective decades of expertise in valuation and transfer pricing to every project. Give us a call to see how we can help you with your business valuation and transfer pricing needs.

Topics: Business valuation

Related Posts

EBITDA Multiples By Industry: An Analysis

EBITDA multiples by industry indicate growth, profitability, and stability of profits in various sectors—and are a quick and easy way to estimate value.

SaaS Company Valuations: What You Need To Know

SaaS company valuations pose some unique challenges for appraisers. Here are the factors that determine SaaS company value.